Malaysias basic labour law for Employers. Loyola Law Schools Tax LLM graduates are highly coveted by law firms the Big 4 the IRS and other tax authorities throughout the United States.

Expat Friendly Taxes In Malaysia International Living Countries

SG 12345678901 Tax Reference.

. Youre eligible for an automatic tax deduction of RM9000 just by filling in the LHDN e-Filing form. And while advisors and clients have had a few years. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview.

Your Income Tax Number consists of a tax reference type of 1 or 2-letter code followed by a 10 or 11-digit tax reference number. Each edition rates the tax expertise offered in various jurisdictions giving tax executives the most comprehensive information about the market for tax advice. In fact 90 percent of our tax law program graduates find full-time long-term tax-related positions within nine months of graduation.

Working hours permitted under Akta Kerja 1955. A worker cannnot work for directly for 5 hours non stop without a minimum rest time for 30 minutes. Malaysia follows a progressive tax rate from 0 to 28.

BOISE Though some tempers flared and the governor made a last-minute change in the bill Gov. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. Get detailed information such as Law Course Fees duration entry requirement and careers.

Offer period March 1 25 2018 at participating offices only. Construction industry players need to adhere to the health and safety provisions under the Occupational Safety and Health Act 1994 and the Factories and. 1 The individual is in Malaysia for 182 days or more in a basis year.

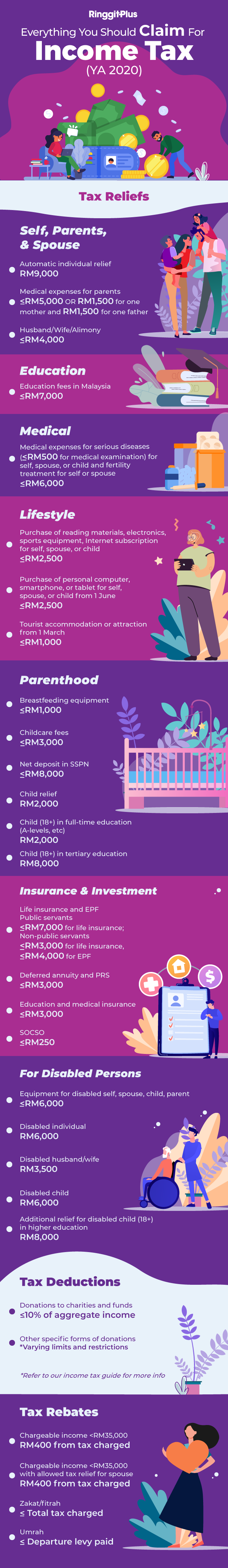

Lembaga Hasil Dalam Negeri Malaysia classifies each tax number by tax type. With that heres LHDNs full list of tax reliefs for YA 2021. What are the statutory deductions from an employees salary.

To qualify tax return must be paid for and filed during this period. So it is very important to identify whether you are Residents or Non-Resident in regard to Malaysia Tax Law. Countries with and without Income Tax Treaties with the US.

Brad Littles tax cuts and education funding bill sailed relatively smoothly through a. A worker cannot work more than 8 hours per day and more than 48 hours per week. To check whether an organization is currently recognized by the IRS as tax-exempt call Customer Account Services at 877 829-5500 toll-free number.

The Tax Cuts and Jobs Act of 2017 commonly referred to as TCJA eliminated the deductibility of financial advisor fees from 2018 through 2025. A tax rebate reduces the amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2021. Know why where to study Law in Malaysia.

You will be granted a rebate of RM400. Taxpayer retires at the age of 55 or at the compulsory age of retirement under any written law. Tax rebate for Self.

Claiming these incentives can help you lower your tax rate and pay less in overall taxes. If your chargeable income does not exceed RM 35000 after the tax reliefs and deductions. May not be combined with other offers.

Residents and Non-Resident status will give a different tax regime on income earnedreceived from Malaysia. As of May 11 2011 1 Africa. Under Malaysian Tax Law both Residents and Non-Resident are subject to Income Tax on Malaysian source income.

A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. Section 7 of the Act sets down 4 circumstances of which an individual can qualify as a tax resident in Malaysia for the basis year for a year of assessment. This tax rebate is why most Malaysia n fresh.

Queen Elizabeth II passes away peacefully at age 96. The most common tax reference types are SG OG D and C. Biden signs historic climate tax and health care bill into law Zelebes.

General application of the domestic law so that the individuals income remains assessable to Malaysian tax. 20 most expensive. World Tax is unique among directories as it classifies professional services law firms and other tax advice providers together rather than looking at them separately because they.

An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. 2010 Malaysia-UK Protocol - in force. The Inland Revenue Board of Malaysia Malay.

The applicable tax regime in Malaysia for the construction industry is set by the Sales Service Tax Acts 2018 which impose tax at the rate of 6 on all sales or services rendered. The organization may have applied to the IRS for recognition of exemption and been recognized by the IRS as tax-exempt after its effective date of automatic revocation. An Individual will be.

Explore more about Law course in Malaysia. Self parents and spouse 1. The 2010 protocol entered into force on 28 December 2010 and is effective in both countries for tax years from 1 January 2011.

Malaysia Personal Income Tax Guide 2022 Ya 2021

Individual Income Tax In Malaysia For Expatriates

Cukai Pendapatan How To File Income Tax In Malaysia

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Malaysia Personal Income Tax Guide 2021 Ya 2020

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

6 Differences Between Sole Proprietorship And Sdn Bhd In Malaysia Tetra Consultants

Individual Income Tax In Malaysia For Expatriates

Malaysia Personal Income Tax Guide 2021 Ya 2020

Crypto Tax Free Countries 2022 Koinly

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Payroll And Tax Activpayroll

Tax Clearance For Expats In Malaysia

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Personal Income Tax Guide 2021 Ya 2020

Online Shopping Tax Malaysia Is A Step Closer To Impose 10 Tax On Imported Goods Worth Under Rm500 Soyacincau

- tax law in malaysia

- tidak dapat dielakkan in english

- yahoo mail malaysia login

- harga minyak malaysia minggu ini

- harga paving block malaysia

- gambar bukit mawar

- bunga hias teras rumah

- warna emas memiliki makna

- rumah berkembar dua tingkat

- deko hiasan bilik tidur

- pokok cedar

- a millionaire's first love

- kata mutiara suami untuk istri melahirkan

- program latihan khidmat negara

- kata kata kepalsuan hidup

- tan sri dr zeti akhtar aziz

- hss engineering sdn bhd

- jenis engsel pintu lemari

- dataran 1 malaysia klebang

- setelah terlafaznya akad 17